Taking the long view for investment success…

OVERVIEW

-

Longview conducts active management of long-only equity portfolios typically consisting of common stocks traded on NYSE and NASDAQ.

-

Longview Investment Management provides active management of concentrated equity portfolios by conducting fundamental analysis of common stocks with the goals of long-term capital appreciation and dividend income growth.

-

Longview’s investment manager, Karl K. Hoagland III, has an uncommon background that combines financial analysis and advisory services in the public sector with entrepreneurial and management experience in the private sector.

-

Longview’s clients have complete transparency and flexibility with their funds under management.

OVERVIEW

Longview Investment Management conducts active management of long-only equity portfolios typically consisting of common stocks traded on NYSE and NASDAQ.

Longview develops equity portfolios by conducting fundamental analysis of common stocks with the goals of long-term capital appreciation and dividend income growth.

Longview’s investment manager, Karl K. Hoagland III, has an uncommon background that combines financial analysis and advisory services in the public sector with entrepreneurial and management experience in the private sector.

Longview’s clients have complete transparency and flexibility with their funds under management.

INVESTMENT APPROACH

-

Longview’s portfolios are typically fully invested, no market timing, and seek long term capital appreciation and growing streams of dividend income.

-

Each stock/company is chosen based on fundamental value analysis and its earnings and cash flow potential over a five- to ten-year period.

-

Longview’s model investment portfolios consist of approximately ten stocks that are generally bought and held for several years. Usually no fixed income and minimal cash holdings – the strategy is 100% equity investment.

-

Longview’s long term approach, broad perspective and value-focus on a concentrated portfolio is differentiated from the majority of trading activity in the stock market.

-

Longview conducts independent and in-house research and analysis. No mandated size, diversification, sector or asset allocation requirements.

-

Longview is seeking to exceed market indexes over the long-term.

-

Longview seeks to optimize tax efficiency for taxable accounts.

THE "SECRET EQUATION"

-

Businesses that are well positioned for future stability and growth (meaning: companies with competitive advantages, expertise or unique assets that will endure or be of increasing value or utility as long-term macro trends and revolutionary changes occur over a 10-plus year time horizon)

-

+ Attractive valuation

-

+ Favorable dividend yield

-

+ Free cash flow to pay down debt, grow dividends and fund share repurchases

-

+ Good management (efficiency mavens, problem solvers and innovators)

-

+ Shareholder oriented board =

-

ALPHA

-

The true challenge is finding stocks that meet ALL of the above criteria.

-

Doing so is Longview’s primary focus.

-

RESEARCH FOCUS

-

Longview's key to successful investing is its focus on the following "equation:"

-

Businesses that are well positioned for future stability and growth (meaning: companies with competitive advantages, expertise or unique assets that will endure or be of increasing value or utility as long-term macro trends and (r)evolutionary changes occur over a 10-plus year time horizon) +

-

Attractive valuation (favorable P/E or Enterprise Value) +

-

Favorable dividend yield (or prospects for initiating a meaningful dividend) +

-

Free cash flow to pay down debt, grow dividends and fund share repurchases +

-

Good management (efficiency mavens, problem solvers and innovators) +

-

Shareholder oriented board =

-

ALPHA (excess investment returns)

KKH CERTIFIED RESULTS AND DISCLOSURES

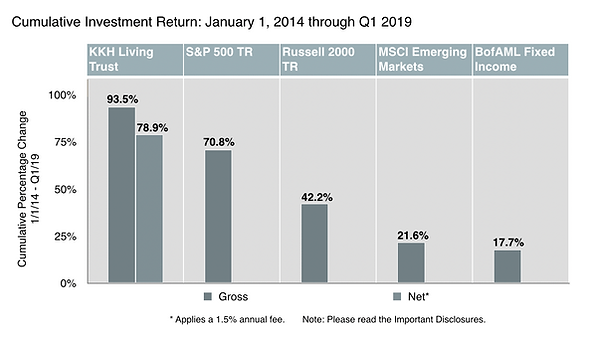

The KKH Living Trust Portfolio was funded with $1million of Mr. Hoagland’s personal assets. The KKH Children’s Trust Portfolio was created with $450,000 in contributions to fund the future expenses of his children (together, the "Portfolios"). Mr. Hoagland managed the Portfolios using an investment strategy similar to the strategy he generally intends to use to manage investment advisory accounts of Longview Investment Management, LLC (“Longview”). The performance for each Portfolio begins with the first full year for which investment data is available.

The results were prepared by Longview from data available to it and were certified by ACA Performance Services, LLC, whose report is attached hereto. Mr. Hoagland managed other assets during this time period but with a different strategy, circumstances and/or constraints. Mr. Hoagland will share those results with potential investors upon request.

Longview believes that the performance shown was generated with an investment philosophy and methodology similar to that described in its Form ADV, Part 2A and that it expects to use in the future. Future investments, however, will be made under different economic conditions and in different securities from those that Mr. Hoagland used for the Portfolio. The attached performance reflects investment of limited funds for a limited period and does not reflect performance in different economic or market cycles. In particular, the amount of assets that generated such performance was considerably less than the expected amount of assets that Mr. Hoagland will invest on behalf of Longview’s clients. Investors may not experience returns, if any, comparable to those discussed herein. This information is historic, does not indicate future performance and is shown only to demonstrate Mr. Hoagland’s experience as a portfolio manager.

Longview believes that comparing the performance of the Portfolio to the S&P 500 TR, Russell 2000 TR, MSCI Emerging Markets TR and the ICE BofAML US Corporate & Government (the “Indices”) is inappropriate. Each of the Indices is broadly diversified and reflects the performance of a specific group of securities in a particular market or sector. They are shown only as indicators of the performance of specific markets during the periods shown. The Portfolio is not nearly as diversified as the Indices and may contain securities and cash not included in the Indices. Because of the differences among the composition of such portfolio and the composition of the Indices, Longview believes that the Indices are not comparable to the investment strategy used to generate such performance. Longview is not aware of any index that is directly comparable.

MANAGER PROFILE

-

Born and raised in the Mid-west

-

Six years on East Coast

-

Thirty years in Northern California

-

Liberal arts and business education

-

Mergers & acquisitions advisor

-

Public equity and debt offering underwriter

-

Entrepreneur and management executive

-

Commercial real estate developer and investor

-

Media publisher and editor

-

Life-long investor in common stock portfolios

SUSTAINABILITY

-

Longview believes that the most successful investments are in businesses that do well (generate and earn growing streams of income) by providing value and enhancing the well-being of customers, suppliers, employees, society and the planet.

-

Shameless self-interest and rampant dishonesty have become all too common in our politics, economy and society. Truth and transparency are increasingly elusive but more important than ever for a sustainable future, and for successful investing.

-

Longview has a bias in favor of companies that are solving the world’s long-term problems and are stewards of all stakeholders and constituents.

-

Longview excludes investments in certain industries and specific companies that have a specific track record of bad acts and/or are working against a sustainable future.

-

In our democratic capitalist system, principled and ethical investing positively impacts outcomes in a meaningful way over the long term.

RESUME

-

Chartered Financial Analyst (“CFA”)

-

Brown University (1983-1987)

-

Honors B.A. Business Economics and Organizational Behavior & Management

-

Men’s Soccer – Four years varsity

-

-

Investment Banker

-

Goldman, Sachs & Co, NY - Mergers and Acquisitions (1987-1989)

-

Montgomery Securities, SF – IPOs, follow-on equity and debt offerings for growth companies (1989-1995)

-

-

Founder/CEO Larkspur Hotels & Restaurants (1996- 2013)

-

From 1996-2000 completed ground-up development and operation of 16 hotels

-

LH&R was a fully integrated hotel ownership, management and brand platform that included 27 hotels and 6 restaurants.

-

-

Owner/Publisher of UltraRunning Magazine (2013-Present)

-

Executive Editor from 2014 – 2018

-

-

Founder and Investment Manager of Longview Investment Management

-

Registered and Licensed Investment Manager (registration as an investment advisor does not imply a certain level of skill or training)

-

-

Western States 100 Endurance Run – 10 Silver Buckles and Trustee

PROFESSIONAL SERVICE PROVIDERS

-

Asset Custodian – Charles Schwab & Co.

-

Law Firm – Shartsis Friese LLP

-

Accountant – Krohn, Watters & Hicks LLP

-

Performance Certifications – ACA Compliance Group

CLIENTS

Longview's clients have total flexibility, transparency, and access to investment holdings

-

Client owns and has direct access to separate account - Longview only has trading authority.

-

Client can terminate Longview immediately at any time for any reason, or no reason.

-

Client can withdraw funds from the account at any time (with advance notification to Longview).

-

Only brokerage expense (if on Longview's Master Schwab platform) is $4.95 per trade (no other fees or commissions).

-

Only management expense is base management fee paid to Longview (which is debited from the account quarterly).

OPENING AN ACCOUNT

-

Client and Longview sign an Investment Management Agreement ("IMA")

-

Client completes survey/questionnaire

-

Longview initiates new account paperwork with Schwab

-

Client receives and completes forms to open Schwab account

-

Client completes Transfer of Assets ("TOA") forms, or transfers funds into the account

-

Longview begins investing the account

NOTES

Since my dad started talking to me about stocks around age 10 I have always been drawn to investing. I still remember him talking about P/Es, quality of earnings and dividend yields during long driving trips or slow mornings in the duck blind.

Things have certainly changed in capital markets since then. But I have never wavered from the basics of fundamental analysis. And it has served me well even in this era of indexing, ETFs, customized factor-investing and now computers developing “robo-advised” portfolios. The investment returns from these low-fee approaches seem to have trounced active managers in recent decades, which is really all that matters when allocating capital.

But for me I just don’t feel right about having my funds invested in any manner other than hand-picking a select group of good companies at attractive valuations. Even though that makes me a dinosaur in the current investment management environment, I believe that an unwavering focus on that approach is still the best way to invest. For peace of mind, and for long- term appreciation.

Consider that today over 50% of all trades on the stock exchanges are made by index funds, ETFs and related investment vehicles that make their trading decisions based only on price and allocations. If a stock goes up, then it must be bought to maintain its representation in the investment pool. If it goes down, the converse is true – it must be sold. To me the long-term implications of that are downright scary.

In terms of other active managers, it seems as though they are shell-shocked and looking over their shoulders at the passive management juggernaut taking over their world Amazon-style. An irony is that in a bid to respond active managers may be chasing the hot stocks and trying to impose allocations and other strategies to keep up with the markets (a futile strategy). Instead, an obsessive focus on what differentiates them – the ability to think independently, make contrarian investment decisions and choose only the cream of the crop for their portfolios - is their differentiating attribute and best response.

That is what Longview will be doing for its investment clients.

CONTACT US

LONGVIEW INVESTMENT MANAGEMENT

Wood Island

80 Sir Francis Drake Boulevard, Suite 4C

Larkspur, CA 94939

KARL HOAGLAND

office: (415)720-1507

cell: (415)578-8998